The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. There are no guarantees that working with an adviser will yield positive returns.

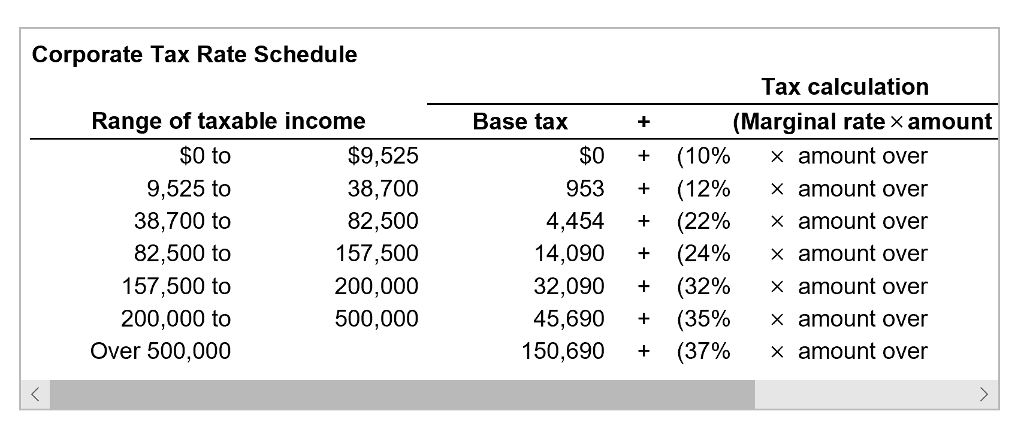

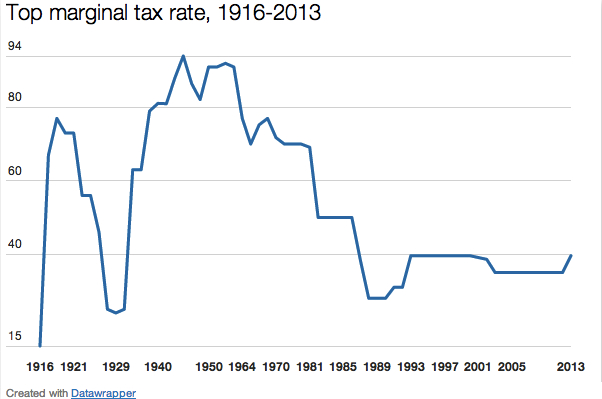

Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). All investing involves risk, including loss of principal. This is not an offer to buy or sell any security or interest. We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. SmartAsset does not review the ongoing performance of any RIA/IAR, participate in the management of any user’s account by an RIA/IAR or provide advice regarding specific investments. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 523,600 and higher for single filers and 628,300 and higher for married couples filing jointly. SmartAsset’s services are limited to referring users to third party registered investment advisers and/or investment adviser representatives (“RIA/IARs”) that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. Securities and Exchange Commission as an investment adviser. If you do not claim Marriage Allowance and you or your partner were born before 6 April 1935, you may be able to claim Married Couple’s Allowance.SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. tax rate schedule for year 2020, what is his current marginal tax rate (Use tax rate schedule.) Multiple Choice 22.00 percent O 32.00 percent 34.00 percent 42.00 percent None of the choices are correct.

You may be able to claim Marriage Allowance to reduce your partner’s tax if your income is less than the standard Personal Allowance. Marc, a single taxpayer, earns 202,500 in taxable income and 6,250 in interest from an investment in city of Birmingham bonds.

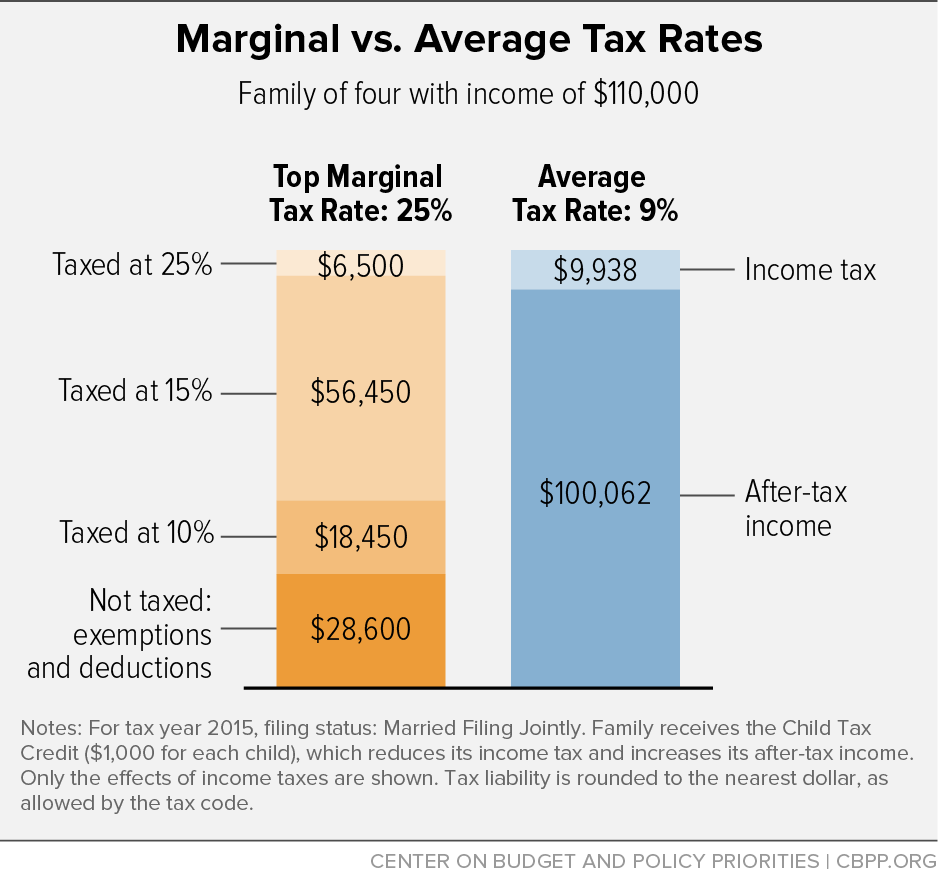

Current marginal tax rate plus#

In reviewing the tax rate schedule for a single taxpayer, Chuck notes that the tax on 75,000 is 5,156.25 plus 25 percent of the taxable income over 37,450. The assignment of tax life and tax recovery method by asset type and industry is largely guided by IRS Publication 946.5 Under current law, tax depreciation. If you’re married or in a civil partnership We can use the above formula to solve for the new tax rate. What is his current marginal tax rate, Chuck, a single taxpayer, earns 75,000 in taxable income and 10,000 in interest from an investment in City of Heflin bonds. You may be able to claim Income Tax reliefs if you’re eligible for them. You pay tax on any interest, dividends or income over your allowances. your first £1,000 of income from property you rent (unless you’re using the Rent a Room Scheme)įind out whether you’re eligible for the trading and property allowances.It only applies to the portion of your taxable income that falls within your. your first £1,000 of income from self-employment - this is your ‘trading allowance’ Your marginal tax rate refers to the highest percentage rate of tax you pay.Use this calculator to determine your tax rate based on income. You may also have tax-free allowances for: Understanding your marginal tax rate can help you plan accordingly for the current tax year. dividend income, if you own shares in a company.how much you’re likely to pay for the rest of the year.how much tax you’ve paid in the current tax year.You do not get a Personal Allowance on taxable income over £125,140. 15.16 percent 12.00 percent 12.78 percent Schedule Y-1-Married Filing Jointly or. What is Mannys current marginal tax rate for 2020 (Use tax rate schedule.) Multiple Choice 10.99 percent None of the choices are correct. You can also see the rates and bands without the Personal Allowance. Manny, a single taxpayer, earns 66,600 per year in taxable income and an additional 12,160 per year in city of Boston bonds. Income tax bands are different if you live in Scotland.

0 kommentar(er)

0 kommentar(er)